An Examination Of The End Users' Purchasing Habits

BY

Dan Weltin, Editor-In-Chief

Sanitary

Maintenance, Contracting Profits, and Facility Cleaning Decisions magazines

POSTED

ON: 8/20/2018

When it comes to product purchasing, end users have a

plethora of options. New innovations flood the marketplace each year,

potentially making traditional methods of cleaning obsolete. In addition,

big-box stores, e-tailers and even manufacturers all compete with distributors

for building service contractor and in-house cleaning manager business.

To help shed light on the 2018 purchasing landscape,

Sanitary Maintenance tapped into research conducted by its sister publications:

Facility Cleaning Decisions’ “Annual Reader Survey,” as well as the “2018

Report On The Building Service Contractor Market” from Contracting Profits and BSCAI.

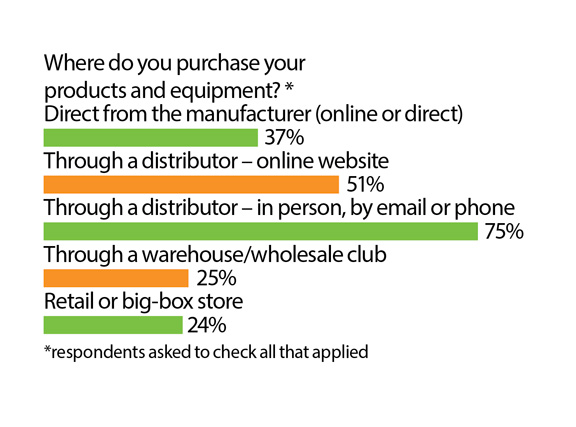

From this data, jan/san

distributors still remain the biggest source of products for both building

service contractors and in-house cleaning managers — and by a wide

margin.

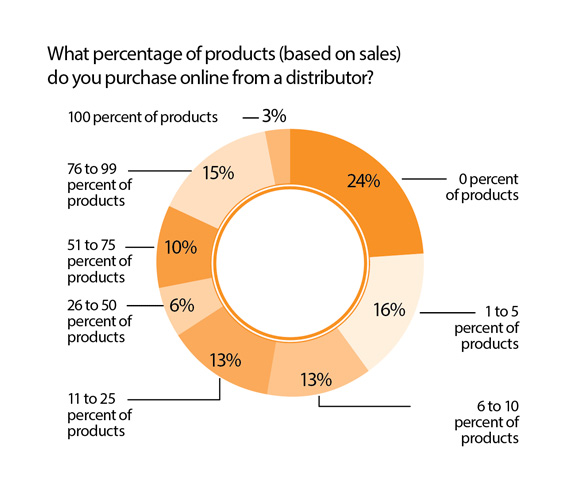

Despite the threat of e-tailers like Amazon Business, end users

don’t want to purchase their products online. BSCs only buy 5 percent of their products from an e-tailer, and

a quarter of BSCs don’t buy any of their products online, even from their

distributors. In-house cleaning managers are more likely to use e-commerce than

their BSC peers, but this ordering method is still less common than an

in-person, phone or email order.

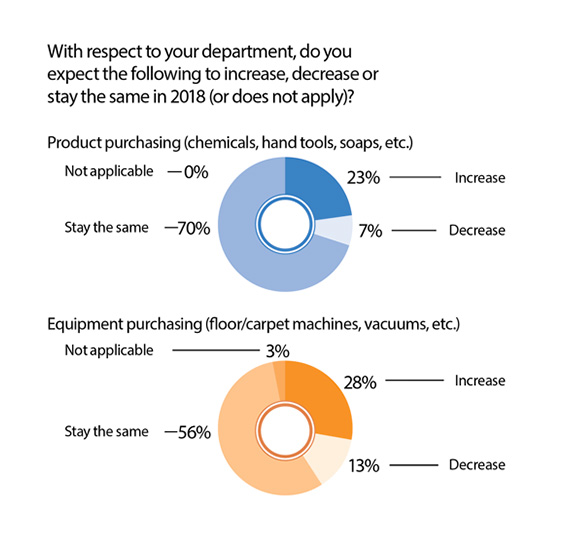

The number of in-house departments increasing their

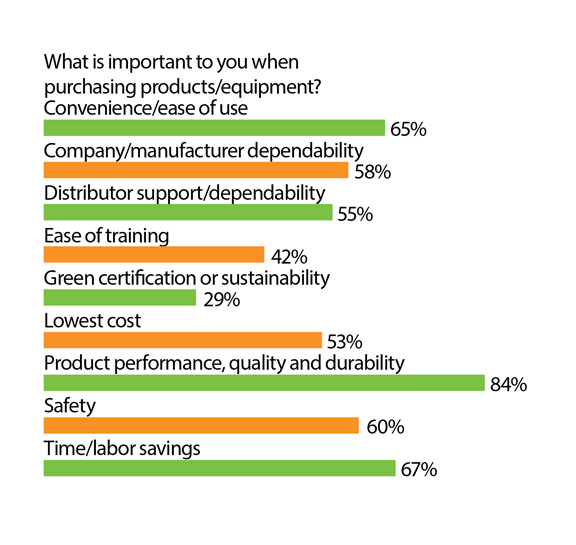

spending on products and equipment rose over 2017. When it comes to choosing

which products to buy and where to purchase them from, low prices still remain

less of a priority for in-house managers. Product performance, durability and

quality is once again the most important reason. Time and labor savings, ease of use, manufacturer dependability,

and distributor support are also more important than a cheap price.

Not surprisingly, frequently used products such as can

liners, brooms, mops and chemicals remain some of the most purchased

products.

However, nearly 20 percent

of BSCs are purchasing engineered water products, which is up from 13 percent in 2017. Despite the fact that more

contractors are embracing this technology, the amount of cleaners purchased

remains relatively unchanged.

Battery equipment is also becoming more common, evidenced

by the fact that half of building service contractors and in-house cleaning

departments are purchasing equipment batteries. And with more battery-powered

backpack vacuums entering the market, corded equipment could eventually be

phased out all together.